– Revenue decreasing 2.4% in Q2

– Net income – Group share decreasing 7.1% in H1

– Founders and reference shareholders announced a tender offer on Devoteam’s shares on July 9, 2020, at a price of €98 per share

H1 2020 consolidated financial statements are available on our website: https://www.devoteam.com/investors/financial-information/

Results for the first half of 2020

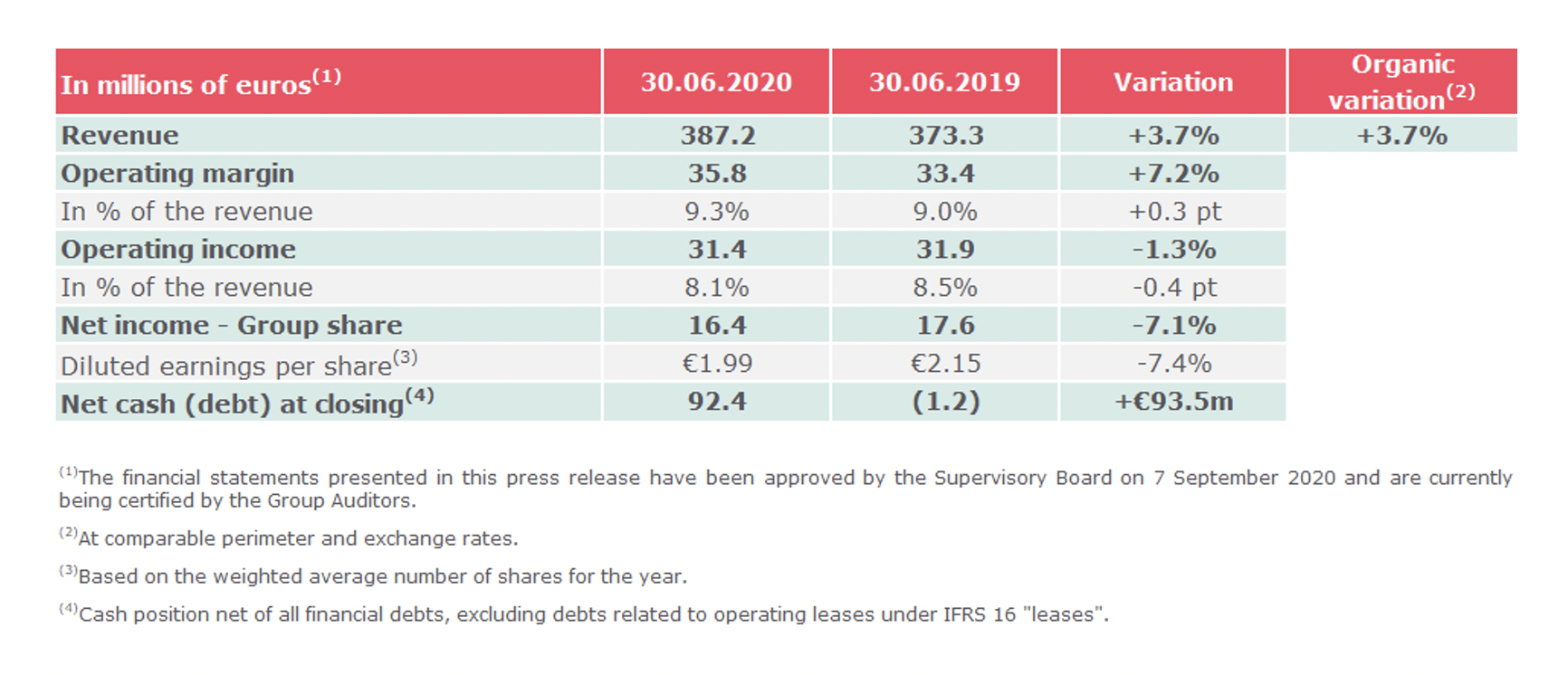

Revenue reached €387.2 million for the first half of 2020, growing 3.7% compared to the same period last year.

Variations in exchange rates and perimeter were marginal. As a result, the organic growth rate also amounted to 3.7%, with a positive working day impact for around 1 point.

During the second quarter of 2020, the Group generated revenue of €180.3 million, decreasing 2.4% compared to the second quarter of 2019, of which 1.7% organically.

Supported by the COVID-19 short-time work measures, the operating margin stood at €35.8 million and 9.3% of the revenue during the first half of 2020. Considering the second quarter only, the operating margin represented 3.2% of the revenue, once restated of the short-time work mechanisms.

The operating result amounted to €31.4 million, slightly lower than the first semester of 2019. It included restructuring costs of €0.6 million, mainly in Germany, the Netherlands and Norway, along with a €1.7 million impairment loss.

The financial result landed at -€2.6 million. It included a €1.2 million foreign exchange loss, a €0.5 million interest expense on the bond issue, a €0.3 million cost related to the application of IFRS 16, and €0.2 million of short-term financing costs (confirmed lines of credit and factoring).

Tax expenses totaled €10.9 million, representing 36.4% of profit before tax, compared to 33.1% during the first half of 2019. Excluding non-taxable profits and other exceptional elements, the tax rate would have been 31.4% in the first half of 2020. The tax rate decreased compared to the same period last year, as a result of the fiscal measures deployed in France.

The Group share of net income decreased 7.1% from €17.6 million in the first semester of 2019 to €16.4 million in the first semester of 2020.

On 30 June 2020, the net cash included a positive impact from the payment deferral of tax and social charges for €20.5 million, following the government measures to support the economy during the COVID-19 crisis. Net cash also included a factor of €14.2 million. Restated from the deferred payments and the factor, net cash was €57.7 million.